5 Key Takeaways From Our UGC Survey Comparing Brands & Consumers

Brands should learn how to meet consumer expectations. Why? A brand that doesn't put the customer first in today's landscape risks losing customers to competitors who meet their expectations. To evaluate the extent of this analysis, we executed a UGC survey with 261 brands and 522 consumers in the U.S. The objective of the survey is to understand how consumers interact with brand reviews and Q&A and contrast that to shopper behavior. Here are five key takeaways from the survey.

1. 78% of young shoppers read reviews on their phones while in a store.

Our survey revealed that 78% of consumers between the ages of 18 and 44 always read reviews while shopping in a store, compared to 22% who never do so. These consumers rely on other shoppers'

opinions on a product's quality, safety, and customer service. What's more, our research showed that these in-store shoppers take time on their mobile phones to read reviews before making a purchasing decision.

With these concerns, brands should always collect and show reviews to consumers. In addition, they should evaluate and analyze these reviews to get insights across various topics. In essence, UGC provides a unique feedback loop for brands. This data can be used to improve products, marketing, customer service and the digital shelf.

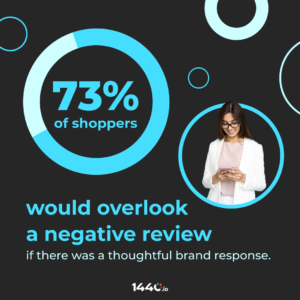

2. 73% of shoppers would overlook a negative review with a thoughtful brand response.

Our UGC survey indicates that 73% of shoppers will still consider purchasing a product with a negative review if the brand has responded sufficiently to the review. Negative reviews are everywhere: from the most established, well-loved brand to the new kid on the block. A thoughtful response lessens the impact of the negative review for brands of all types. Some sites, like Amazon, have revoked the ability for brands to respond. But brands should respond on sites that allow it.

→ Grab Your Full Copy of the Consumer Reviews and Q&A Expectations Survey!

3. 81% of consumers expect a brand response to a negative (1, 2, or 3 stars) review

Consumers post negative reviews to share their concerns with fellow shoppers and communicate the issues with the brand itself. Of course, these consumers expect the brands to address the crisis and resolve the issue. In our UGC survey; 81% of shoppers said they expect a response on their 1-3 star reviews. When a brand doesn't respond, consumers don't know whether the brand is working on the problem.

4. The Disconnect: Consumers expect brands to make changes based on reviews, but fewer brands offer a response.

77 % of the shoppers indicate that they expect a brand to resolve a problem after posting a negative review on their page or website. 79% expect the manufacturer to correct the misinformation on the product description after getting consumer feedback. While consumers expect the issues to be addressed and action taken to fix the problem, only a few brands respond to the call.

Our survey identified that only 61% of the brands make changes based on consumer reviews. Also, only 56% of these brands have corrected inaccurate descriptions to respond to consumers' concerns. Brands should use UGC insights to improve their products and satisfy consumers.

5. 89% of consumers read Q&A, yet the largest brands are the least likely to respond (14% always do so).

Even before the global pandemic, eCommerce was booming. Now, it's exploding. With online shopping, consumers are unable to get fast answers to questions like they once could in a retail store. Instead, they rely on the online Q&A to help them make an informed decision while buying a product. In our UGC survey, 89% of consumers stated they look at the consumer Question and Answer section before purchasing a product. In addition, 12% of consumers ask questions themselves.

However, a mere 14% of brands with 5,000 or more employees always respond to Q&A. And 33% of them never do! When consumers don't get quick, accurate responses to their questions, it becomes a big problem for the brand. Unanswered questions pose a red flag, and most of them avoid purchasing the product. So as a brand, monitoring and responding to Q&A on all channels gives consumers the confidence to buy the product.

UGC Management Strategy

Our UGC survey highlights why brands must create a system to meet consumers' expectations for Reviews and Q&A. This type of User Generated Content has become a key factor as a consumer makes a decision. Consumers expect engagement and issue resolution on the part of the brands. If you are having trouble coordinating your Review and Q&A Management strategy, you have come to the right place. At 1440, we provide UGC management tools that help you analyze, monitor and respond to reviews and Q&A from different channels within a single platform. See how it works.

Consumer Reviews and Q&A Expectations Survey

Download your copy of the full report.